Software is a popular type of accounting system you can use to streamline your bookkeeping process. Depending on the software you choose, you can save your time and money and focus on what matters—running your business. But first, you need to know about accounting software setup. Lucky for you, our guide makes setting up accounting system as easy as pie.

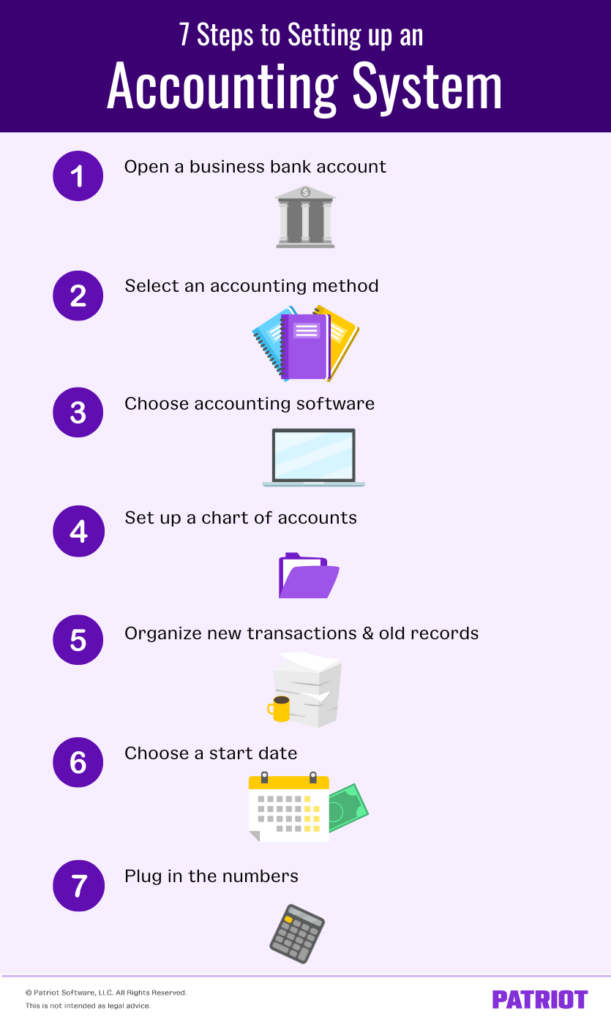

Read on to learn more about our seven easy-to-follow steps for setting up accounting software.

Accounting setup isn’t rocket science, but if you don’t know where to start it can feel overwhelming. Here are seven easy-to-follow steps on how to set up an accounting system.

Before you choose and set up accounting software, you should think about opening up a separate business bank account. Some business structures must open a separate bank account (e.g., LLC, corporation, or limited partnership). Even if it isn’t a requirement for your business, the IRS does suggest that you do. It’s the simplest way to keep things organized.

Keep a separate account for your business to:

There are three accounting methods to choose from: Cash-basis, modified cash-basis, and accrual accounting.

Cash basis is the simplest method of accounting. Cash-basis accounting uses the single-entry method of accounting. With single-entry, you record each transaction as one entry as they happen. This accounting method is best for short-term transactions.

Modified cash-basis accounting is a happy medium between cash-basis and accrual accounting. Modified cash-basis uses the double-entry method of accounting. You can use cash-basis for short-term transactions and accrual accounting for long-term items such as long-term liabilities and accounts payable. In other words, you record transactions when money changes hands, and even when it hasn’t yet.

Accrual accounting can feel complicated to a beginner. Accrual uses the double-entry method of accounting. With accrual accounting, you record transactions when they take place, regardless of whether you’ve received any money yet. This is the best method to track funds over long periods.

First, you need to know how to choose the right accounting software for your business. After all, there are plenty of options to consider. So many in fact, it can feel a bit overwhelming. But, it’s easier than you think.

Before you choose software, let’s cover the basics. There are two types of accounting software to choose from: Cloud accounting and desktop software. Cloud accounting allows you to work from wherever you are, while desktop software generally keeps you tethered to the single computer or device you downloaded your software to.

Whichever type of accounting software you choose, there are a few other considerations you need to keep in mind. Make sure that your accounting software: